Alumni Spread the Yale Model of Endowment Management

In 2017-18, Bowdoin College’s endowment, led by Paula Volent ’97, posted a 15.7% investment gain, reportedly the highest in the country. The extraordinary success of Yale SOM graduates in managing university endowments is a testament to the school’s rigorous, impact-focused, and cross-sectoral approach to finance.

By Dana Cook Grossman

Earlier this month, Bowdoin College reported that its endowment, led by Paula Volent ’97, had posted a 15.7% investment gain in 2017–28—according to Bloomberg, the highest return among U.S. schools with substantial endowments. It was the latest evidence that the long game of institutional investing is one played extraordinarily well by the many top endowment managers with Yale SOM degrees.

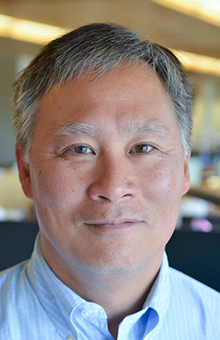

Take Dean Takahashi ’80 B.A., ’83, for example. He took a job with the Yale University Investments Office in 1986, two and a half years out of SOM and just shy of a year after Yale’s now-legendary chief investment officer, David Swensen ’80 PhD, arrived there. “When I started,” Takahashi says, “Yale had a billion and a half dollars, and we’ve now generated more than $40 billion of gains since then.” Over those 32 years, Swensen, Takahashi, and their colleagues have generated returns of 12.8% per annum—a record unequalled among institutional investors.

But many other institutions are now nipping at Yale’s heels as a result of the fact that during those three decades, SOM has seeded numerous graduates into the field. Takahashi ticks off the names of a few SOMers—including Volent and Andy Golden ’89 at Princeton University—who “have some of the top endowment track records over the long term. It’s pretty extraordinary how well they’ve done.” (See box below for more of the Yale SOM grads managing endowments.)

Also extraordinary is how the Yale cohort has changed the field. “It used to be,” explains Volent, who is now in her 19th year at Bowdoin, “that endowments were pretty sleepy.” Endowment managers “just invested in stocks and bonds, railroad stocks, maybe some faculty housing.” But now, for example, Bowdoin’s portfolio “is very global; we’re looking at opportunities in China, Latin America, and emerging markets and the endowment portfolio has significant investments in alternatives including venture capital, private equity, and hedge funds.” During Volent’s time there, the Bowdoin endowment has grown from $465 million to $1.6 billion, thanks to a 9.2% annualized investment return.

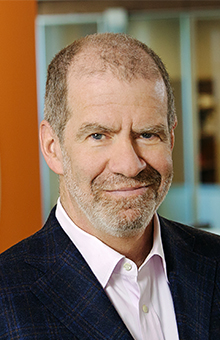

The same thing is true at Princeton, where Golden has headed the investment office for almost 24 years. “Our work today is quite globalized,” he says. “More than a third of our key relationships are located outside of the U.S.” During his tenure at Princeton, the endowment has grown from $3.5 billion to $26 billion on the back of a 12.6% annualized investment return.

How did Yale SOM come to have such an outsize impact on the once-sleepy world of institutional investing? Golden calls it “quirky…a happy accident. Dave [Swensen] and Dean [Takahashi] were revolutionizing the way endowments get managed,” he explains, “so SOM happened to be located a few blocks away from ground zero of an industry getting shaken up. And their commitment to higher education created this virtuous cycle—they’re teaching classes, therefore attracting new colleagues who are similarly motivated to join them.” While their primary responsibility is managing Yale’s endowment, Swensen and Takahashi teach one or two courses each year; in fact, both were selected to receive the inaugural Merton J. Peck Prize for excellence in teaching from the Yale Department of Economics this year.

Indeed, both Volent and Golden got drawn to the field after their arrival at Yale SOM by working with Takahashi and Swensen. Perhaps coincidentally, both also came to the field as a second career. Volent entered SOM after a “pretty successful, exciting career” in art conservation, and Golden was a professional photographer when he decided to switch gears and go to business school.

But both quickly “fell in love with finance and endowments,” as Volent puts it.

“Some people ask, ‘How do you feel about helping your competitors?’” Takahashi observes dryly. “The nice thing is that they’re all friends, so it’s great to see them succeed. It’s also part of the mission of higher education,” he explains, to teach and mentor others. He pauses, then adds with a chuckle, “We like to see them do well, but we’d like to do better.”

Takahashi, Volent, and Golden agree that the field’s rewards include intellectual challenge (“it’s a nice combination of theory and practice,” says one; “it has variety times depth,” says another); teamwork (“you get to work with really exceptional people”); and a sense of mission (“there’s something quite rewarding about knowing that we’re facilitating all the good stuff that goes on in the modern university”).

“Another thing that’s nice about endowment management is you get feedback that’s very direct and specific,” says Takahashi. A manager’s performance evaluation is essentially in the institution’s rate of return.

“The funny thing,” he continues, “is that when I was a student at SOM, the whole idea was that we were supposed to take the best practices from the for-profit world and apply them to work in the nonprofit and public sectors.” But over the decades, the tables have turned. When he and Swensen began working together 32 years ago, “we really had no experience whatsoever in institutional portfolio management. So, coming from a more academic background, we took a different direction than what was conventional” and maintained “skepticism toward what Wall Street wants to sell investors.”

As a result, he says, the management of nonprofit endowments “is now the best-in-class—the example of how to manage things—rather than what’s going on in the corporate world.”

For all the success, endowment management is a field that remains in flux. “Every day,” says Volent, “there’s something new—the regulatory environment, tax issues, bitcoin. The markets have become more complicated, but continue to fascinate.”

A Network of Stewardship

A select list of Yale SOM alumni overseeing investments at major institutions, building on the school’s legacy of endowment management.

- Steve Algert ’90, Managing Director and Assistant Treasurer, J. Paul Getty Trust

- Peter Ammon ’05, Chief Investment Officer, Penn Office of Investments

- Jenny Chan ’18, Chief Investment Officer, Children’s Hospital of Philadelphia

- Lisa Howie ’08, Director, Yale Office of Investments

- Dale Kunkel ’98, Director of Hedge Fund Strategies, Gordon and Betty Moore Foundation

- Elena Sands ’91, Senior Investment Officer, The Metropolitan Museum of Art

- Michael Shay ’09, Director of Investments, The Museum of Modern Art

- Ellen Shuman ’84, Founder and Managing Partner, Edgehill Endowment Partners