Startup Stories: An Investment Platform for Latin America

A conversation with Renato Carregha ’23, whose startup offers residents of Latin America a crypto investment platform aimed at building wealth in the region.

In this series, Karen Guzman talks to student and alumni entrepreneurs about how they are making an impact with their startups.

Founders: Renato Carregha ’23; Marcos Cohen; Jorge Villalobos

Venture: Naos aims to provide opportunities for Latin Americans to build wealth through a crypto savings plan platform that allows investors to create personalized savings plans based on risk profile.

What was the moment when you had the idea for this startup?

We’ve run an investment fund in crypto for friends and family since 2016. During my time at SOM, it went through a difficult period and was close to dying. In class we learned about a framework that explained how the challenges you face in a situation can act as a constraint on possible solutions and so help you narrow your ideas. Based on our issues, it was clear to me we needed a much larger pool of resources to manage, and that gave me the idea of pushing for a mass-market product. Simultaneously, we had submitted our legal model for validation and not only did we get a good response, but the lawyers told us that we could go to a mass-market audience with a few minor tweaks.

At first, we were working on a version of our fund with lower minimums and a friendly front end. However, during the Tsai CITY Summer Fellowship we learned through talks with mentors that our product was targeted at a niche population who already understood crypto and that we needed to understand what motivators could push someone to crypto as a solution rather than how to better offer crypto itself. With this final piece of the puzzle in place, we came up with the idea of a savings plan as a way to align how people are used to saving in our region with the most intelligent approach to investing in a highly volatile asset.

What’s the problem you’re trying to solve or the gap that you’re trying to fill?

We want to address the lack of high-quality investment products for middle-class Latin Americans. The region has very low financial education, and access to high-quality financial products is limited to people who have technical knowledge or high liquid wealth.

What was the most important resource Yale SOM contributed to your startup?

Time to think and be exposed to different methodologies to solve problems.

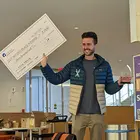

What’s the biggest milestone your startup has hit since graduation?

Launching our live product (November 20, 2023)! Other than that, we have successfully closed an angel round and formed the key partnerships we need to get the product to market.