A Day in the Life: Adil Sahdev ’24

We spent a day with Adil Sahdev, a student in the Master’s Degree in Asset Management program, as he went to class, studied with friends, and enjoyed New Haven cuisine. Photos by Tony Rinaldo.

7:56 a.m.

On Tuesday mornings I start by going Olmo to pick up my coffee before my early Quantitative Investing class. They sell really good coffee and I have a great friendship with the owner. I have a monthly subscription. Usually I go get coffee twice a day.

While I’m drinking my coffee, I try to read some news, so if there is something interesting going on in finance I can get the professor’s take. That way you get to understand what is happening in the economy at the same time you’re studying the concepts in class.

8:27 a.m.

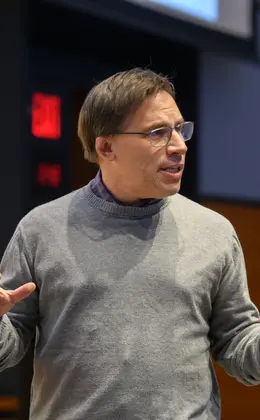

This class is about building quantitative strategies, which is exactly the work that is being practiced in the industry. In our program, the majority of the courses are taught by industry professionals. This class is taught by Professor Tobias Moskowitz, who is a principal at AQR Capital, which is one of the top quant hedge funds in the world. He’s a professor here and a partner at AQR. He teaches us things that are directly applicable in our day-to-day work. Toby has worked closely with Eugene Fama, who is a father of quant finance. Getting a chance to learn from such professors is a one-of-a-kind opportunity.

The class is a bit intense, because they are trying to teach us some novel concepts. We have to put in the work.

After class, Krishna was showing me a credit bond pitch, which he was going to present in a session right after our class. Just a friend helping another friend going through his presentation. Then Krishna made his bond pitch in an Investment Management Club credit pitch session. He was preparing this pitch to present in a competition, so he was showing people how to build a credit pitch and at the same time getting to test his pitch in front of us. He was able to learn what questions people can ask and prepare those questions for the competition.

He presented some basic concepts of how bond valuation works and I was asking whether we should use a clean price or a dirty price, which is bond terminology. Since I have studied this, I was asking some questions and getting him to explain the jargon he’s throwing at us.

This is my friend from the MBA program, Prakhar Rustagi. We try to dedicate some time to put in work on job applications and recruitment. It’s good to have an accountability buddy. We’ll sit together, putting in applications, getting each other’s opinion on what to write an email to a prospective employer. Or trying to share our network resources and just help each other out. We hang out a lot, going for dinners or going for a run. I just bumped into him while coming back from the bond pitch. We ended up having lunch as well.

We got lunch at Nica’s Market. They have really good food. Every day, they have different varieties of pastas. I cook a lot but when I take a break, Nica’s is my go-to place. It gives me a chance to get outside the university and do a bit of walking and get some sunshine.

This was Business Ethics, taught by Jason Dana. He’s a great professor. Before every class we have to go through some readings and we post our opinion in a discussion post. Then he calls upon people in the class and asks them to share their thoughts on a particular ethical dilemma in the case being presented. He’ll ask you your opinion and then he’ll give you some other input. “What if the situation was this or this? Now tell me how do you think about that? Would your stance is as firm as it was before, or now you feeling the ethical dilemma here?” He challenges your opinion by giving you different inputs, and also by calling upon students with contrasting views at the same time. It gives you a lot of things to think about. Hearing different perspectives broadens your thinking.

We had a TA office hours session for Financial Econometrics and Machine Learning, which is another very quant heavy course. That course is being taught by Professor Bryan Kelly, who is head of machine learning at AQR. We were asking some questions to get ahead on the assignment for next week.

This is my Financial Econometrics and Machine Learning. Yansen Zhao, who is also on my Quantitiative Investing team, is from the MAM program. He did his MBA at the University of British Columbia and he’s coming directly to do his advanced management course here. And Laura McCraine is in the Asset Management program with me. She came straight from her undergrad. We were discussing the assignment and allocating the work, trying to figure out how to approach the homework.

Then we decided to go out for a dinner. When you work so much on assignments, you get to treat yourself from time to time. We had dinner at Lazeez, which is a north Indian restaurant. What we do is, I’ll take them for Indian cuisine and then they’ll take me for Chinese cuisine. This week, they’ll take me out and introduce me to some authentic Chinese cuisine.