Student Project Examines Racial Disparities in Retirement Savings

Building on a class assignment, a team of students in the MBA for Executives program created an initiative last fall that explored ways to encourage retirement planning in African-American and Latino populations.

By Karen Guzman

Building on a class assignment, a team of students in the MBA for Executives program created an initiative last fall that explored ways to encourage retirement planning in African-American and Latino populations.

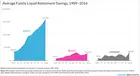

“What we found was really remarkable,” said Fatimah Loren Dreier (Muhammad) ’22, a health executive for a national company. “There is a huge gap in African-American and Latino retirement savings, and that gap must be met with understanding and action.”

The project grew out of the first-year core Customer course, taught by K. Sudhir, the James L Frank ’32 Professor of Private Enterprise and Management and a professor of marketing.

Sudhir has taught the course for years, but he returned last fall with plans to update the curriculum. Inspired by the resurgent Black Lives Matter movement in the summer of 2020, Sudhir broadened one of the course’s raw case studies, which explores how to market TIAA retirement plans to populations that have traditionally not done well at saving for retirement. The case originally looked at two populations: millennials and women. Sudhir added African-American and Latino populations to the mix.

“The consumer journey for any product is not uniform across people,” he explained. “This exercise was a way to think more inclusively in terms of how journeys differ across people within the larger economy that is diversifying rapidly.”

Sudhir began the case by giving his students data on how quickly the U.S. population is diversifying, and the challenges and opportunities that these changes present to businesses. Students were then asked to analyze the savings habits of two of the three demographic groups in the case.

But none of the students, in any section of the course, opted to focus on African-American and Latino communities. Students cited two reasons, according to Sudhir: lack of familiarity with the demographics’ savings habits and a lack of detailed data about the communities. Students of color were also concerned that they would spend too much time educating their classmates about communities of color.

“These two reasons may reflect why there are limited efforts in targeting retirement products to minorities,” Sudhir said. “There’s often less data available, and even if employees have interest and know how to better target these markets, they may not feel enough support and don’t want to do the heavy lift themselves. More broadly, this may reflect why marketing towards minority communities is not as widespread as it could be given the size and profit opportunities offered by these markets.”

The class discussed the results of the assignment, and that’s when Dreier and several of her classmates asked for Sudhir’s support organizing a separate research project to target the African-American and Latino communities.

“I really appreciate that Professor Sudhir supported our decision to explore this topic more. We mitigated some of the initial challenges by inviting any student with an interest in this topic to join new learning teams. We also encouraged students to bring new research to the table,” said Dreier, who has a longstanding interest in the topic. In her efforts to launch a fintech company, she conducted a small informal survey of African-American spending habits and views in 2016. “Part of the reason I came to Yale SOM was to explore the intersection of health equity and wealth creation in communities of color,” she said; Dreier is a fellow in the Pozen-Commonwealth Fund Fellowship in Health Equity Leadership.

Twelve students participated, on two teams. One studied the African-American community, and the other studied the Latino community. Dreier incorporated data from her earlier research, and the teams examined national data sets and TIAA aggregated data, and conducted interviews with small business owners and employees.

“The findings were very revealing,” Dreier said. “They helped us better understand how a particular person views their financial management, and what we can do to impact it. Even when individuals of color have financial resources, they are not leveraging those resources to save.”

There are various obstacles to marketing products across a diverse society, Sudhir said. Marketers need to identify how to better reach out to various groups, crafting messages that speak to their particular needs and utilizing influential individuals within the communities. For example, the team pointed to financial influencers with podcasts and blogs targeted toward the African-American community. These influencers, with tens of thousands or even hundreds of thousands of followers, could be more trusted and effective in spreading the message about retirement than more traditional advertising channels.

The language that financial companies use to describe their services can also be off-putting, Dreier said. Individuals surveyed tended to respond more positively to the term “financial coach,” as opposed to “financial advisor.”

Dreier noted that a study by Prudential Financial, Inc. found that only two out of 10 African-Americans use a financial advisor. “Stuffy terms that are associated with the ‘old guard’ can intimidate new retirement savers,” she explained.

Andrew Tate, TIAA’s director of retirement engagement marketing, works with Yale students on the case every year. “The students bring fresh perspectives on topics and channels that can break through as consumption behaviors change and new platforms emerge,” he said.

“Their ideas are thoughtful and innovative, and it was great to hear their energy as they looked at the case through a lens of inclusion with an eye toward engaging underserved populations.”

Gabriel R. Ramirez ’22, a supply chain and operations manager in the consumer packaged goods industry, was part of the team that focused on the Latino community.

“I have the reference point of my own experiences with navigating the world of personal finance and retirement planning, but the opportunity to work on this project gave me added insight into our community’s contributions to the American economy,” he said.

Since 2010, the number of Latino business owners has grown by 34%, compared to 1% for all business owners, Ramirez said. But not enough of that wealth is going into retirement savings. “Due to lower levels of generational wealth, Latinos are likelier to encounter lower credit scores, higher interest rates, and higher rejection rates of loans,” he said. “Many small businesses instead turn to friends or family for startup capital. While this has led to a distrust of financial institutions in the community, big opportunities exist for companies willing to put in the work to earn that trust.”

At the project’s completion, the teams presented their findings to their EMBA classmates. The response was positive. “To the credit of my fellow students, there was overwhelming support and interest to learn more about wealth-building within communities of color,” Dreier said. “TIAA was also very helpful, and the experience was a great starting point for everyone who wants to encourage change.”