Conference Recap: YBlockchain? for Business and Society

On October 1, 2019, the Yale School of Management International Center for Finance (ICF) hosted an event: YBlockchain? for Business and Society in which industry experts discussed the impact of blockchain technology in business. Yale SOM alumni Diana Barrero Zalles '17, gives an overview of the October event in which she organized the speakers and their panels as well as moderated the event. She is currently working with the Yale ICF and student groups to coordinate the next installment of the YBlockchain? initiative.

The Yale ICF will host the third iteration of the YBlockchian? conference series, which has been a pleasure to organize and moderate so far. These discussions have brought fascinating speakers to the Yale campus to talk about blockchain, applications that make sense, and implications on several aspects of business and society.

The previous event last fall covered business models that work beyond the hype: what is the potential of blockchain to transform our lives, and what institutional and regulatory frameworks must be in place to ensure long-term sustainability in the space.

Blockchain Introduction

Kelly LeValley Hunt, Blockchain Advisor and Partner at XLP Capital, gave an introduction to blockchain. She’s been active in the space since early crypto initiatives, collaborating with Joe Lubin, the co-founder of Ethereum, and shared her insights on how distributed ledgers work. She explained the resilience of these systems, which do not depend on a trusted centralized authority that may fail under extreme circumstances (as seen in the financial crisis). In a decentralized system, all participants are nodes in a network, where the failure of one node does not affect the entire system because nodes are directly connected with each other and do not depend on one single intermediary.

She explained the difference between fully decentralized public blockchains, where any member of the community can make changes on the ledger, and private blockchains, where there is a form of centralized governance to vet content being posted. The role of consortiums can be to provide these governance measures to private ledgers. The role of miners can be to validate incoming records on public ledgers.

The Ethereum blockchain in particular allows holding representations of data on a distributed ledger. One particular development is the use of smart contracts, which she predicts will be increasingly adopted in the next decades and will change the future. Their role in automating agreements can streamline operations across industries including music, real estate, asset transfers, and research. There are already groundbreaking projects being built that can significantly improve efficiencies in banking, government, healthcare, insurance, food, and several other industries.

Here is a list of resources that Kelly recommends for anyone interested in the space: https://github.com/Scanate/EthList/blob/master/README.md

Opening Keynote: Tension Between Regulators and Innovators

The opening keynote was given by David Weild IV, Chairman of Weild & Co, which has adopted a decentralized model for an investment bank serving emerging growth companies. He is also former Vice-Chairman of the NASDAQ and “Father” of the JOBS Act, which enabled regulated crowdfunding avenues for private companies to access capital, in the context of decreasing US IPO volumes. He called himself a “capital markets zealot” because access to financing is what drives innovation, and ultimately the global competitiveness of an economy.

In the United States, there has been a dramatic decline in small IPOs, whereas other countries, particularly China, have seen a dramatic increase. US startup rates have been decreasing, with declining access to capital, and less avenues to take companies public: a trend he foresaw during the onset of Regulation ATS and electronic markets. When we see a loss of middle market investment banks, we should be troubled and should take steps to fix the underlying issues.

Blockchain technology represents the ability to disintermediate the intermediaries and reduce transaction costs. It could facilitate asset transfers, benefiting areas like remittances and dividend payments. An immigrant sending small sums of money abroad could do so at a lower cost. A stock can offer more frequent distributions, and since the market values this, it may be able to trade at a premium to net asset value. Securities that trade better have a yield. Ultimately, any asset can be tokenized and traded on a blockchain system, making use of a software layer, and recording transactions on a shared ledger. Tokenization alone, however, will not guarantee liquidity. While low levels of liquidity for tokenized assets can be attributed to the fact that most people don’t have cyberwallets, there may be a stronger case that the markets for them are still underdeveloped.

While clients want to maximize their ability to access any investor, the ICO hype showed “nonsense” in the expectation for tokens to increase in price without undergoing the regulated procedures of securities offerings. “The mission of the U.S. Securities and Exchange Commission is to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation.” Yet while startups seek talent, capital, and speed, regulation can increase costs and decrease speed. Innovators at times disrupt in ways that can also look to disrupt regulations.

The SEC has been particularly cautious because Congress can threaten to cut its budget, its mistakes can be amplified by the press, and complaints of constituents and lobbyists can represent significant implications. Thus, the SEC will generally not make controversial decisions when there is no balance in its staffing. Incidentally, the ICO boom developed while there were still gaps in SEC staffing. As soon as it reached full staffing, Chairman Jay Clayton’s famous Senate testimony, “I believe every ICO I’ve seen is a security,” was released and the number of ICOs began to decrease. Moreover, the SEC’s fictitious HoweyCoin website was released as a spoof on ICOs to warn investors on the risk. A 2017 study estimated that 80% of ICOs were scams.

Legislation in this space signals to the SEC that there is an appetite for this market. The trajectory of regulatory developments points toward innovations fitting into traditional regulatory boxes. One example is the INX project, which is developing a market infrastructure to exchange a range of cryptoassets from tokens to derivatives, and launching a security token and public offering to finance itself. Developments like these can create a precedent for future blockchain projects.

Overall, blockchain is a very important technology that will disrupt several businesses. Yet in disintermediating centralized parties, it also opens the opportunity for participants to finance terrorism and illicit activities. Transferring cryptocurrencies between unregulated exchanges and sites has presented important risks. Cases like $1B worth of cryptocurrency values traced from Venezuela into Switzerland, without knowing who was behind this, have been “causing regulators some indigestion.”

Panel Discussions: What Makes Business Models That Work

John D’Agostino, Managing Director at DMS Governance, posed that reducing frictions in transactions will not automatically bring liquidity. While he calls himself a “cynical enthusiast,” he acknowledged that the future will have a digital store of value and payment system of some form. For the time being, blockchain infrastructures may be better suited for high latency, low frequency transactions than for low latency, high frequency transactions like those of securities markets. The game Fortnite, for instance, made more money than Amazon by selling skins, physical manifestations of identity in digital form. These high latency periodic transactions would translate very well into blockchain in these early stages.

In the realm of financial inclusion, it is key to have the needs of end users in mind: food, water, and medical care are much more relevant than awful ICOs and bad early stage companies. The old school system of credit is still doing quite well, with alternative credit systems performing only marginally better if at all. The advent of mobile finance in markets like Africa, with telecom companies as enablers of innovations, can be considered one true example of sustainable transformation that can set an example for blockchain developments.

He also pointed out the difference between lit markets, which permanently identify human beings behind activities on the blockchain, and dark markets where identities are not associated with accounts. Lit markets seem like the way to go, as institutional investors would only be comfortable investing in cryptoassets with these functions. A shift from dark markets to lit markets could represent a shift toward greater institutional investment. In this context, “code is law,” is one of his least favorite phrases because code is immutable, whereas law is not; law progresses with innovation.

Frances Newton Stacy, Director of Portfolio Strategy at Optimal Capital, acknowledged that existing institutions have a statutory precedent and common law that can be an advantage for innovation. While an inherent mistrust in institutions has arisen over time, instead of disrupting them altogether, the best strategy is to innovate along with them. New developments can work within institutions to reduce their inefficiencies and innovate their functions with tools like stablecoins.

Central banking in particular is an area that the crypto community needs to better understand. There must be an elastic mechanism to control the money supply, given inflationary and deflationary pressures. Inflation occurs when there is too much money relative to goods, and deflation occurs when there are too many goods and not enough money to pay for them. Stablecoin issuers that set out to “disrupt the Central Bank” may not understand this reasoning and could be better positioned to innovate Central Banks instead.

Ken Lang, Managing Partner and CTO of COSIMO Ventures and member of the ndau Collective, emphasized how blockchain systems within institutions can restore a sense of trust. Consensus mechanisms are essentially agreements on what is true, which can be applied for digital governance, dispute resolutions, identification, and ultimately an underlying sense of epistemology. This requires an understanding of why institutions function the way they do. While blockchain can be another kind of database, it is important to identify what it is actually good for, which may be something much larger beyond the concept of a database.

The best solutions are not “all or nothing,” either purely cryptographic or purely within traditional institutional frameworks. There is an ideal middle ground between “code is law” and the status quo, which is harder to achieve. Innovators can explore opportunities in this middle ground and integrate the best of both worlds. In order to defend what works, and understand why, we need experience from a lot of disciplines coming together.

Jeff Bandman, CEO of BlockAgent, co-founder of the industry association Global Digital Finance, and former CFTC regulator, pointed out that with programmable software, we are experiencing a transition from the internet of information to the internet of value. This presents a need for an adequate infrastructure for it to run on. We can’t completely do away with intermediaries because we need regulations and investor protections. For instance, a transfer agent for assets recorded on a blockchain can track the owner of record off-chain as a “golden source of truth” in the securities space.

There is a need for an entity to specialize in associating wallets with identities, and there is efficiency in outsourcing this function. The ownership record can enable the provision of recourse in case of hacks, where funds may be traced but impossible to recover. In cases where private keys are lost, smart contracts can be programmed to freeze client assets or restore their funds. In consistency with the current regulatory framework, we don’t want securities to go missing with no recourse to investors.

Closing Keynote: Global Digital Asset and Blockchain Trends: How Tech is Colliding with Government, Law, Money and Societal Organization

The final keynote was given by Sandra Ro, CEO of the Global Blockchain Business Council, who previously launched the Bitcoin futures as Executive Director at the CME Group. She gave a macro perspective of blockchain developments on a global level relative to the United States. The opportunity sets for what tech can do to solve real world problems that are growing, with massive adoption foreseen in unique industry groups despite waves of innovation that can be “lumpy, bumpy, and messy.” Worlds are colliding, with a loss of trust in institutions and massive technological growth.

Energy, financial services, food, healthcare, and land/real estate are major sectors that are ripe for blockchain disruption. The aviation industry in particular is developing several use cases along these verticals. In financial services, Santander’s launch of a public blockchain is a major milestone that is already challenging the initial conceptions that only private ledgers could be suitable for enterprise use cases. In JP Morgan’s IIN Network for interbank settlement, over 200 banks have already signed up. In the realm of remittances, mechanisms to allow moving $2 in a frictionless way can have a huge impact.

Adoption in the developing world is different from that in the US, across public and private sectors. When discussing megatrends, it is important to take into account demographic shifts. Africa is estimated to add another billion people on this planet in the next two decades, with a population that will be on average 14-19 years old. The average age in the US will be 38, and for Japan and Germany, it will be about a decade older. This means that the growth engines of the future, and the people positioned to solve tomorrow’s problems, are “actually sitting in different parts of the world.” If we don’t do something about this now, to provide them with education and resources, the migration and refugee crises we’re witnessing may only get worse.

In the realm of environmental and climate change, there is also an urgent need to implement solutions beyond discussing them. Among the global blockchain initiatives she’s worked with, she mentioned a blockchain hackathon in Rwanda, focusing on green economy problem sets. A promising youth population with energy and desire is missing investment dollars, education, and support.

In areas of the world where communities may not have water, electricity, or proper housing, they often still have a phone. This represents a massive technological reach but also a major source of vulnerability. Massive data leaks are quite common and often glossed over. The largest identity breach in Ecuador’s history took place in 2019. For account holders of one particular bank, all personal financial information was made publicly available for a short period of time. This was in part due to the fact that a third party startup in possession of the identities of all 16M+ Ecuadorian citizens had been outsourced for certain services without the right security measures.

Trust is a foundation, and incidents like Facebook’s Cambridge Analytica scandal will get worse if we develop no adequate mechanisms to treat data. So far, local and regional initiatives like GDPR in the European Union and privacy laws in California amount to patchwork solutions to what could represent a major global security risk.

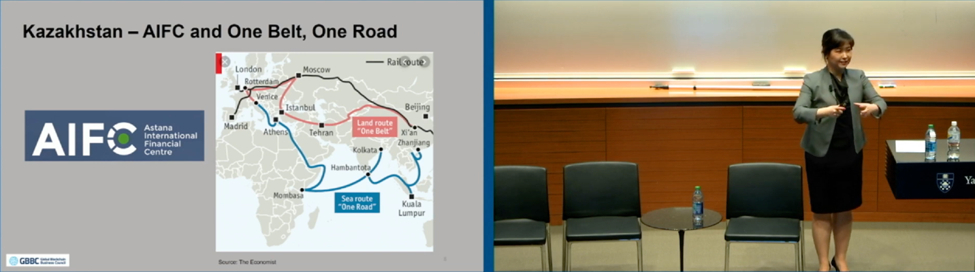

In the realm of government institutions adopting blockchain innovations, Kazakhstan recently launched a new economic zone to promote cryptoassets and innovation. It has adopted English law, English language, and has gained impressive traction attracting blockchain companies. With the One Belt, One Road initiative for global commerce, companies from areas like the Middle East, Europe, and Asia can view Kazakhstan as a central point for an Asian outpost.

On the other hand, the case of Venezuela and the Petrocoin can be an example of how cryptocurrencies can be used for wrongdoing. We need to wait and see whether a society can build itself over from the ground up through digital assets, in ways that can again instill trust.

Finally, the Vatican has started a discussion with the tech industry on the common good, human dignity, and what can happen to technology in a world where we become so digital that we may not think of the social implications of what we do. There is a need to develop adequate consciousness to recognize that tech may not be as neutral as technologists have purported it to be. Building algorithms that are implicitly biased, as in taking data sets that come from only one demographic, can build inequality into the architecture of a technology. This calls for the need for collaboration and building bridges across technologists, business people, religious groups, and other groups, to ensure a human-centric approach to the problems we solve with technology.

[POSTPONED] Coming Up Next: YBlockchain? Risks of Cryptoassets

The upcoming discussion will cover the risks of cryptoassets, as the main hurdles to mainstream adoption. These risks have ranged from concerns over money laundering and illicit financing to investor and consumer protections.

[WATCH] YBlockchain? for Business and Society — October 1, 2019

About Diana Barrero Zalles ‘17: Diana has experience in the investment banking offices of the World Bank and the Inter-American Development Bank, managing large cross-border transactions, applying big data visualizations to identify global investment opportunities, and regulatory compliance. She stepped into the blockchain space through the lens of compliance, as COO of a regtech startup during the ICO boom. This led to her market research on stablecoins with R3, and further work with decentralized financial market infrastructures, regulatory proposals, and stablecoin use cases. Diana contributes to Global Digital Finance to standardize best practices for cryptoassets and is coordinating a blockchain discussion series at Yale, to promote meaningful discussion over hype. She went to the University of Notre Dame and has an MBA from Yale.

About Diana Barrero Zalles ‘17: Diana has experience in the investment banking offices of the World Bank and the Inter-American Development Bank, managing large cross-border transactions, applying big data visualizations to identify global investment opportunities, and regulatory compliance. She stepped into the blockchain space through the lens of compliance, as COO of a regtech startup during the ICO boom. This led to her market research on stablecoins with R3, and further work with decentralized financial market infrastructures, regulatory proposals, and stablecoin use cases. Diana contributes to Global Digital Finance to standardize best practices for cryptoassets and is coordinating a blockchain discussion series at Yale, to promote meaningful discussion over hype. She went to the University of Notre Dame and has an MBA from Yale.