Use of Federal Reserve Programs – 12/18/2020

Below we report on operational Fed programs, based on the Fed’s weekly H.4.1 release. Since our last report, the use of lending facilities has increased to $92.6 billion due to increased use of the PDCF, CCF, MLF, and MSF. The outstanding amount of the Fed’s U.S. dollar swap lines has also increased.

As of December 16, the Fed’s liquidity programs had $92.6 billion in outstanding loans. The total outstanding has risen from $87.1 billion on December 2, the last time we reported the usage (see the post here).

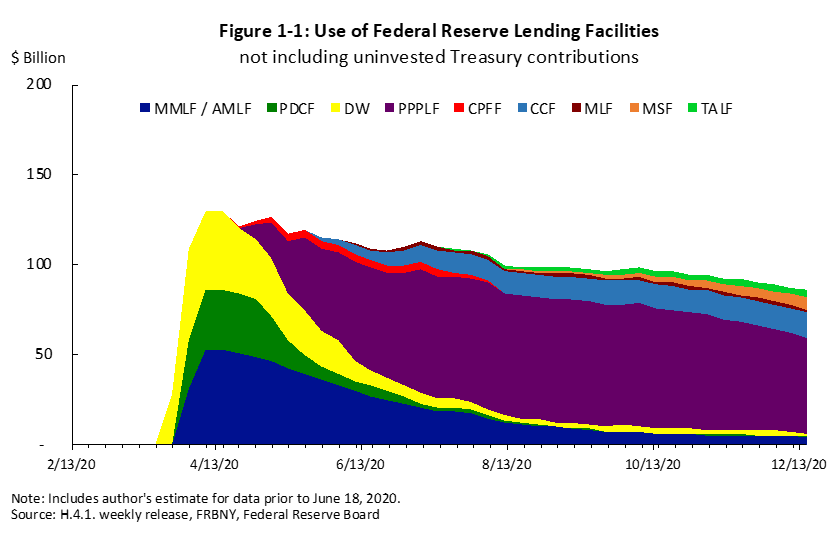

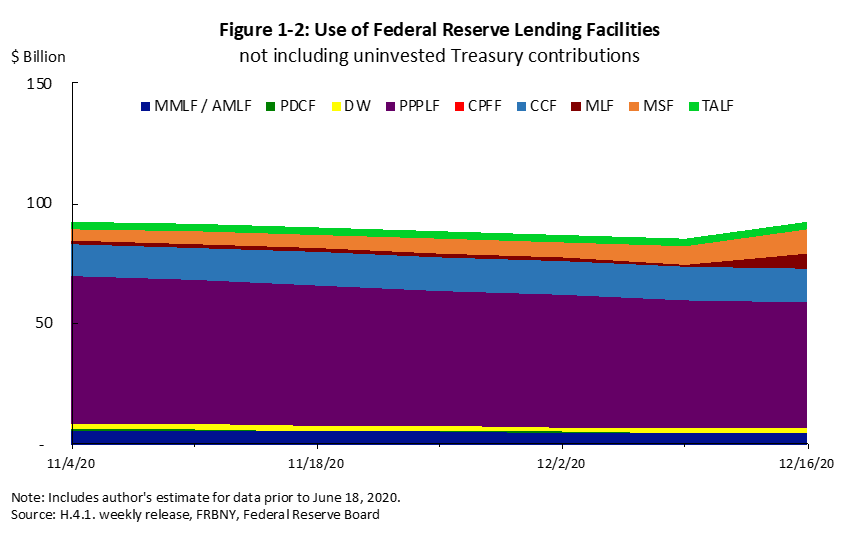

Figure 1-1 and 1-2 show the outstanding amount of each facility, not including Treasury contributions that are invested in Treasury securities rather than loans to market participants. Figure 1-1 shows the use of the lending facilities from early 2020 and Figure 1-2 shows the use in a shorter time period, from November to December.

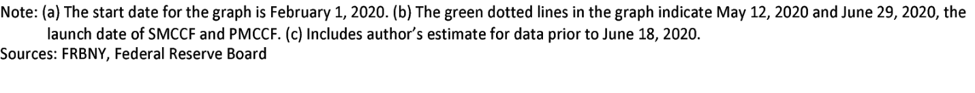

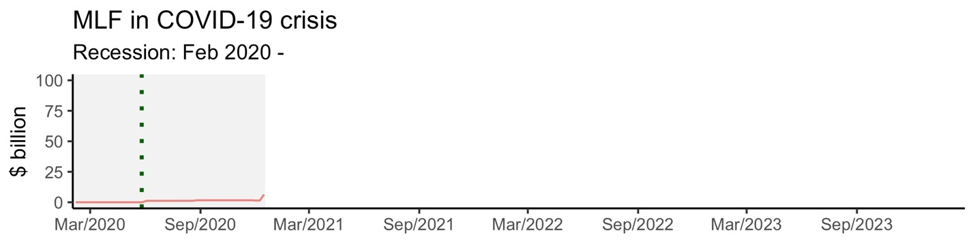

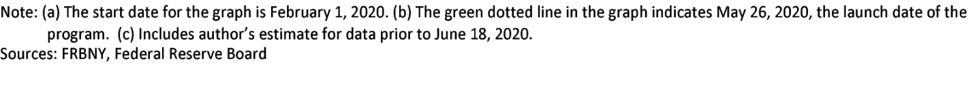

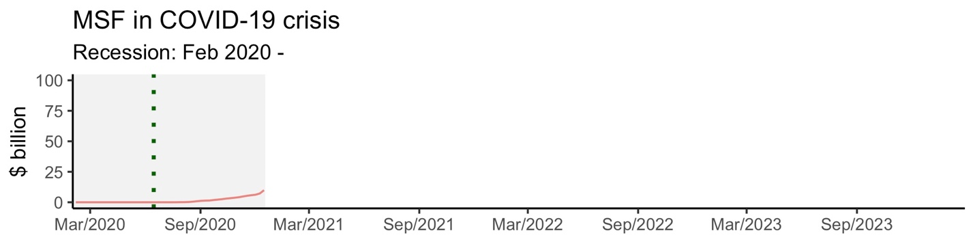

The use in four facilities (PDCF, CCF, MLF, and MSF) has increased since the last time we reported the usage on December 2. On December 16, the use of MSF, CCF, and MLF saw record volume since the outbreak of COVID-19.

Note on the Municipal Liquidity Facility (MLF)

The use of MLF has increased by $4.9 billion. According to Bloomberg and Bond Buyer, the increase is attributed to the incremental use by New York’s Metropolitan Transportation Authority (MTA) of $2.9 billion and the state of Illinois of $2.0 billion.

MTA, according to Bloomberg, may need to reduce subway and bus service by 40% and slash rail service by 50% if it does not receive the MLF from the Fed.

The state of Illinois has a budget hole of approximately $4 billion and the $2 billion Fed loan should cover part of it. The state of Illinois had already borrowed $1.2 billion from the Fed to deal with a $2.7 billion fiscal 2020 pandemic hole and is expected to repay the first borrowing by June 30, 2021.

Note on the counterparties of the Commercial Paper Funding Facility (CPFF)

On December 9, the Federal Reserve Bank of New York (NY Fed) announced the launch of a prequalification process for cash investment management services for the CPFF. This follows the statement on October 5 announcing a new initiative to secure competitive procurement in the vendor for the sake of equal opportunities (for the further details, see here). The due date for prequalification is December 23.

Note on Treasury Contributions to Federal Reserve Programs

On April 9, the Treasury announced that it intended to use funds available under the Coronavirus Aid, Relief, and Economic Security (CARES) Act to purchase equity in special purpose vehicles established under Fed lending programs.

In total, the Treasury has invested $114 billion—including CARES and non-CARES funds—in six facilities, as of December 2. Per the facility agreements, 85% of the equity contributions to the CCF, CPFF, MLF, MSF, and TALF have been invested in nonmarketable Treasury securities: $31.9 billion for the CCF, $8.5 billion for the CPFF, $14.9 billion for the MLF, $31.9 billion for the MSF, and $8.5 billion for TALF.

On November 19, the Treasury published a letter from Secretary Steven T. Mnuchin to Jerome Powell, Chairman of the Federal Reserve Board of Governors. The letter indicated the Treasury would not extend the programs established under the CARES Act after December 31. These include the facilities for corporate bonds and loans, municipal bonds, and asset-backed securities (the SMCCF, PMCCF, MSLP, MLF, and TALF), which have equity funding that the Treasury provided under the CARES Act. (For a discussion of these developments and the future of the Fed emergency lending facilities supported by CARES Act funds, see this YPFS blog post.)

Note on Federal Reserve Swap Lines

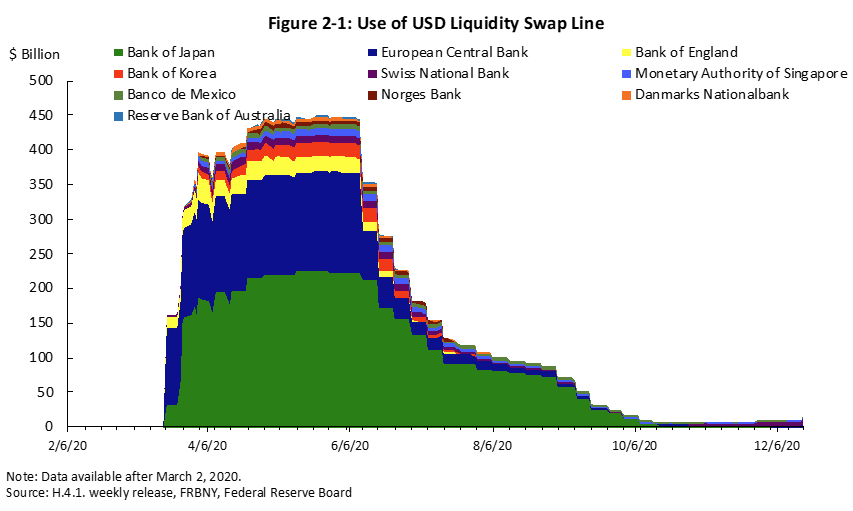

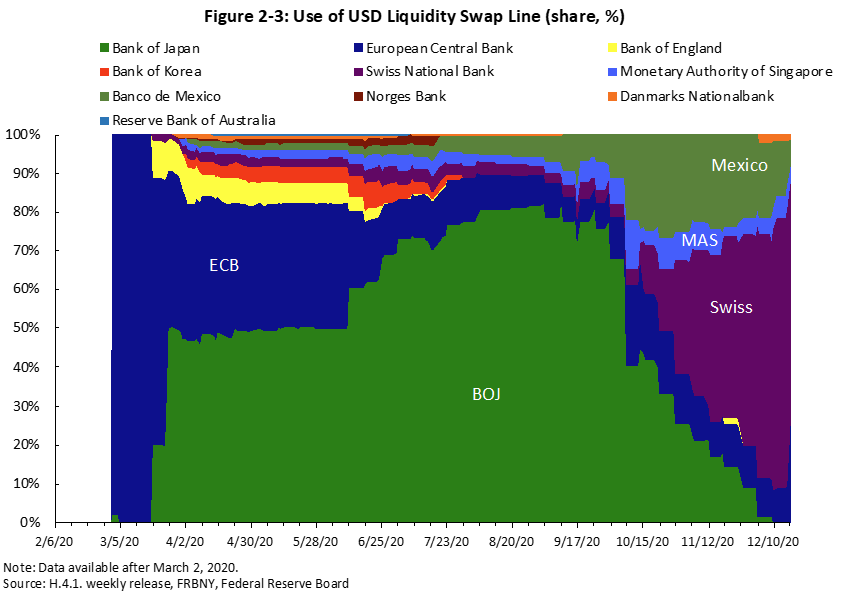

Figure 2-1 and 2-2 show the outstanding amount of the Fed’s U.S. dollar swap lines. Figure 2-1 shows the use from early 2020 and Figure 2-2 shows the use in a shorter time period, from November to December.

Central banks increased their use of the Fed’s U.S. dollar swap lines. As of December 17, the total amount outstanding is $16.1 billion. Compared to the peak on May 27, this is still a 96% drop; however, the amount has significantly increased from $9.1 billion, on December 3, the last time we reported the usage (see the post here).

The recent increase in the use of the U.S. dollar swap lines can be explained by several central banks: Swiss National Bank, European Central Bank (ECB), Monetary Authority of Singapore (MAS), and Danmarks Nationalbank (Denmark). Meanwhile, the Bank of Japan (BOJ), which once used to represent the highest share of usage, no longer has any outstanding U.S. swaps with the Fed (Figure 2-3).

For further details on the use of Federal Reserve Programs, please refer to the Fed’s monthly report to Congress.

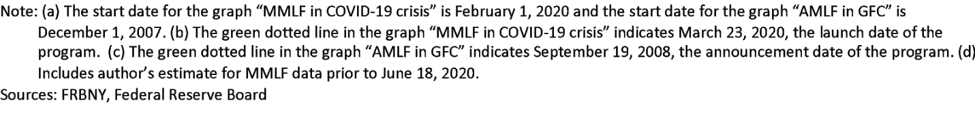

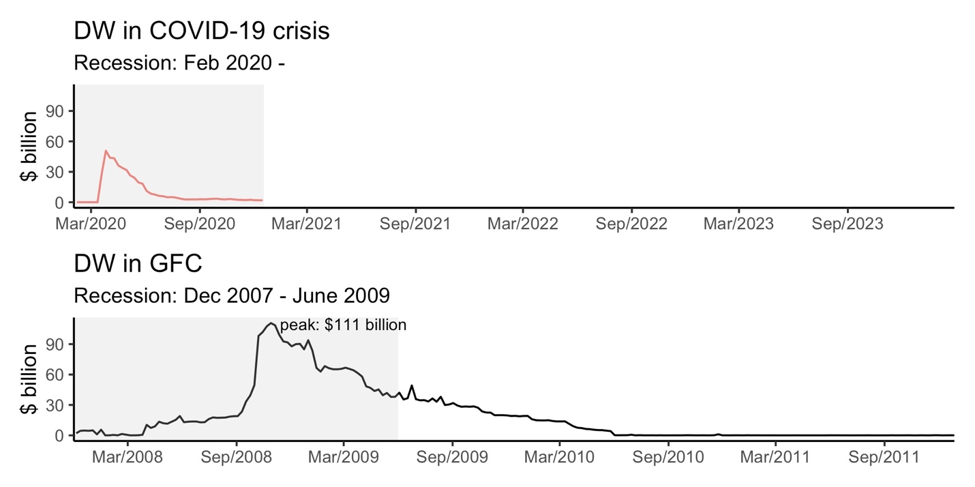

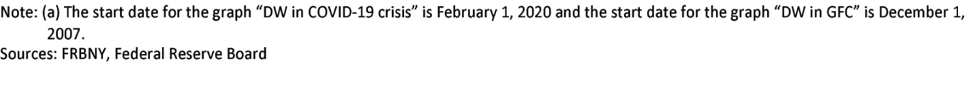

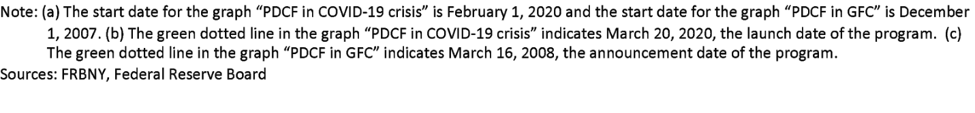

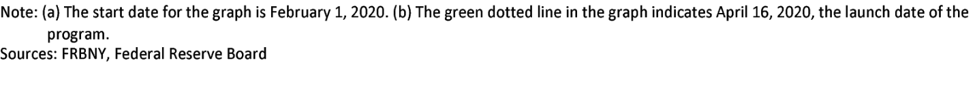

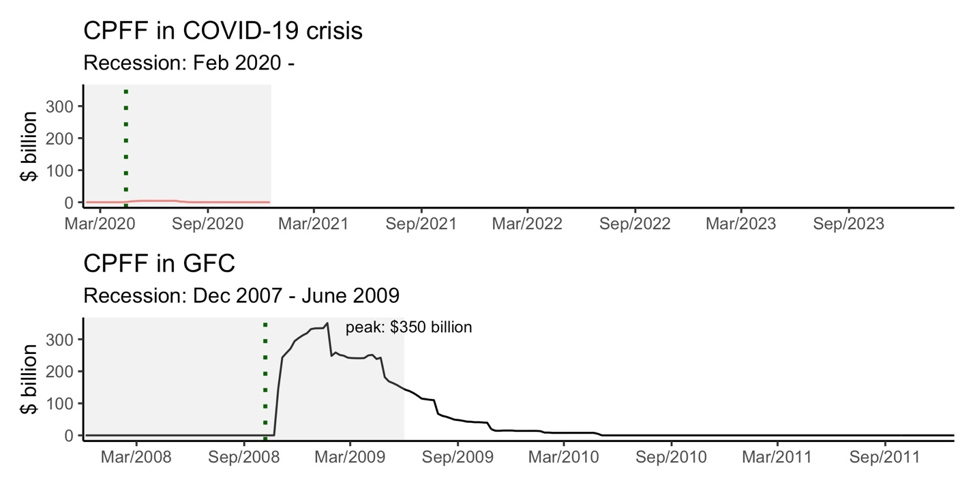

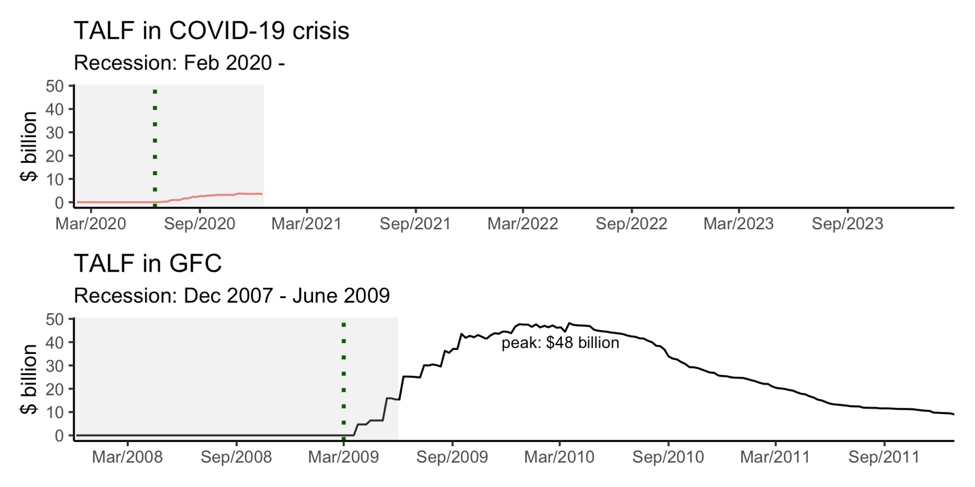

The following figures show the usage of Fed programs during the COVID-19 crisis. They also show data for similar programs during the Global Financial Crisis of 2007-09 (GFC), where applicable. The graphs also indicate how soon each program was launched relative to the start date of recessions (February 1, 2020, for COVID, and December 1, 2007 for GFC). The actual take-up of these facilities has been relatively low compared to the take-up of similar facilities during the GFC.

For a more detailed comparison of Fed programs during the GFC and the COVID-19, see our Key Program Summaries.

Money Market Mutual Fund Liquidity Facility

The MMLF allows the Fed to fund the purchase of money market mutual fund (MMF) assets. The program is established under Section 13(3) of the Federal Reserve Act. The Fed reported that the U.S. Treasury, to date, has provided an equity cushion of $1.5 billion to the Money Market Mutual Fund Liquidity Facility—as part of $10 billion total in credit protection. The facility had $4,449 million in outstanding loans on December 16. It is similar to the Asset-Backed Commercial Paper Liquidity Money Market Mutual Fund Liquidity Facility (AMLF) that the Fed launched during the GFC. The AMLF funded the purchase of ABCP from MMFs. In comparison, the MMLF is authorized to lend against a broader range of collateral.

Discount Window

The DW is a standing facility that allows the Fed to provide collateralized loans to depository institutions. It had $1,871 million in outstanding loans on December 16.

Primary Dealer Credit Facility

The PDCF allows the Fed to extend collateralized loans to primary dealers. The facility was established under Section 13(3). The facility had $350 million in outstanding loans on December 16.

Paycheck Protection Program Liquidity Facility

The PPPLF allows the Fed to provide financial institutions with liquidity backed by loans to small businesses extended under the federal government’s Paycheck Protection Program and guaranteed by the Small Business Administration. The PPPLF was established under Section 13(3). The facility had $52.1 billion in outstanding loans on December 16.

Commercial Paper Funding Facility

The CPFF provides a liquidity backstop to issuers of commercial paper and was also established under Section 13(3). It is operated by the NY Fed through a special purpose vehicle, the Commercial Paper Funding Facility II LLC (CPFF II LLC). The Treasury has made an equity investment of $10 billion in CPFF II LLC. The facility had no outstanding loans on December 16.

Primary and Secondary Market Corporate Credit Facilities

The PMCCF and SMCCF were set up under Section 13(3) to support credit to employers through purchases of newly issued bonds and support market liquidity for outstanding corporate bonds. These facilities operate through a special purpose vehicle, the Corporate Credit Facilities LLC (CCF LLC). The Treasury has made an equity investment of $37.5 billion in CCF LLC. The SMCCF had $14.1 billion in outstanding assets on December 16. The PMCCF has not extended any credit to date. Additional transaction-specific disclosures regarding the SMCCF as of end November can be found here.

Municipal Liquidity Facility

The MLF provides liquidity to states, counties, and cities. The facility was set up to purchase up to $500 billion of short-term notes and was established under Section 13(3). The Treasury has made an equity investment of $17.5 billion in MLF LLC. The facility had $6,361 million in outstanding loans on December 16.

Main Street Lending Programs

The MSF is established under Section 13(3) to provide loans to small and medium-sized businesses. The program operates through five facilities: the Main Street New Loan Facility (MSNLF), the Main Street Priority Loan Facility (MSPLF), the Main Street Expanded Loan Facility (MSELF), the Nonprofit Organization New Loan Facility (NONLF), and the Nonprofit Organization Expanded Loan Facility (NOELF).). The loans for all five facilities are extended through a special purpose vehicle, the Main Street Facilities LLC (MSF LLC), established by the Federal Reserve Bank of Boston. The Treasury has made an equity investment of $37.5 billion in MSF LLC. The facility had $9,911 million in outstanding loans on December 16.

Term Asset-Backed Securities Loan Facility

The TALF is established under Section 13(3) to provide liquidity collateralized by asset-backed securities (ABS). Under the facility, the Federal Reserve lends to holders of certain AAA-rated ABS. The facility operates through a special purpose vehicle to extend its loans, the Term Asset-Backed Securities Loan Facility II LLC (TALF II LLC). The Treasury has made an equity investment of $10 billion in TALF II LLC. The facility had $3,458 million in outstanding loans on December 16.

Also, see the summary Table from our Key Program Summaries.

Also, see the summary Table from our Key Program Summaries.