Use of Federal Reserve Programs - 07/23/2020

Below we report on operational Fed programs, based on the Fed’s weekly H.4.1 release. Since last week, the BOE has ceased its use of the swap lines. The use of PDCF and MMLF has declined, and the PPPLF now represents 63 percent of the total amount outstanding.

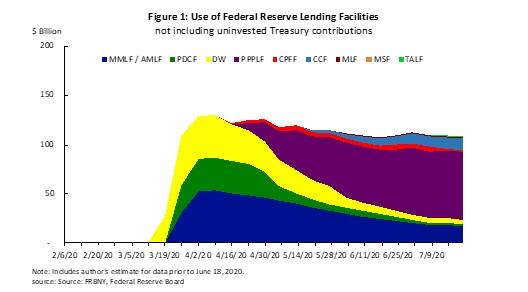

As of July 22, the Fed’s liquidity programs had $108.3 billion in outstanding loans, slightly down from $109.1 billion last week.

Figure 1 below shows the outstanding amount of each facility, not including Treasury contributions that are invested in securities rather than loans to market participants. Earlier versions of this report (link) included Treasury contributions that the Fed had not yet invested.

Fed officials have noted the relatively low usage of Fed programs compared to similar programs during the Global Financial Crisis of 2007-09. Recent Fed research shows that simply announcing the facilities helped restore market confidence this time. Establishing the lending facilities “boost[ed] confidence to the point where borrowers are able to access credit from the private market at affordable rates,” said John C. Williams, President of the Federal Reserve Bank of New York.

On July 23, the New York Fed announced that it is looking to expand its counterparties and agents for the CPFF, SMCCF, and TALF. It said it expects the larger cohort of counterparties and agents will increase the Bank’s operational capacity and the accessibility of these facilities.

Note on Treasury Contributions to Federal Reserve Programs

The Treasury announced on April 9 that it intended to use funds available under the CARES Act to purchase equity in special purpose vehicles established under Fed lending programs.

In total, the Treasury has invested $114 billion in six facilities, as of July 22. Per the facility agreements, 85% of the equity contributions to the CCF, CPFF, MLF, MSF, and TALF have been invested in nonmarketable Treasury securities: $31.9 billion for the CCF, $8.5 billion for the CPFF, $14.9 billion for the MLF, $14.9 billion for the MSF, and $8.5 billion for TALF.

Note on Federal Reserve Swap Lines

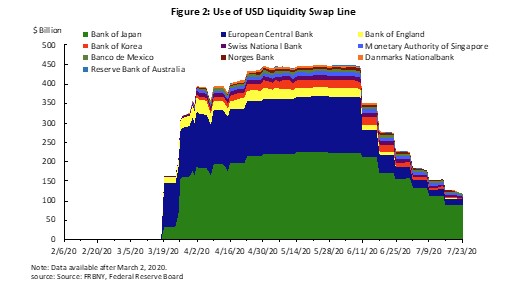

Over the past month, central banks continued to reduce their use of the Fed’s USD swap lines. The reduction is partially due to the expiration of 84-day swaps entered during the early weeks of the crisis. Auctions for these swaps were conducted weekly. As these contracts are reaching maturity, the total outstanding amount declined to 26 percent of its peak on May 27. As of July 15, the total amount still outstanding is $118 billion, down from $128 billion last week.

The BOE reduced its outstanding amount by $395 million and it no longer has outstanding USD swaps with the Fed. At $90 billion outstanding, the BoJ’s share now represents 76 percent of the total. The ECB stands at $14 billion; together the two hold 88 percent.

The following figures show the usage of Fed programs during the COVID-19 crisis. They also show data for similar programs during the Global Financial Crisis of 2007-09 (GFC), where applicable. The new graphs also indicate how soon each program was launched relative to the start date of recessions (February 1, 2020, for COVID, December 1, 2007 for GFC). The actual take-up of these facilities has been relatively low compared to the take-up of similar facilities during the GFC.

Liquidity Swap Lines

The USD swap lines are bilateral agreements between the Fed and foreign central banks. They allow foreign central banks to exchange domestic currency for US dollars. The Fed currently maintains swap line agreements with 14 central banks.

Money Market Mutual Fund Liquidity Facility

The MMLF allows the Fed to fund the purchase of money market mutual fund assets. The program is established under section 13(3) of the Federal Reserve Act. The Fed reported that the U.S. Treasury, to date, has provided credit protection of $1.5 billion to the Money Market Mutual Fund Liquidity Facility. The facility had $17.5 billion in outstanding loans on July 22.

Discount Window

The DW is a standing facility that allows the Fed to provide collateralized loans to depository institutions. It had $4.6 billion in outstanding loans on July 22.

Primary Dealer Credit Facility

The PDCF allows the Fed to extend collateralized loans to primary dealers. The facility was established under section 13(3). The facility had $1.9 billion in outstanding loans on July 22.

Paycheck Protection Program Liquidity Facility

The PPPLF allows the Fed to provide financial institutions with liquidity backed by loans to small and medium-sized businesses extended under the federal government’s Paycheck Protection Program and guaranteed by the Small Business Administration. The Program was established under section 13(3). The facility had $68.5 billion in outstanding loans on July 22.

Commercial Paper Funding Facility

The CPFF provides a liquidity backstop to issuers of commercial paper and was also established under section 13(3). It is operated by the FRBNY through a special purpose vehicle, the Commercial Paper Funding Facility II LLC (CPFF LLC). The Treasury has made an equity investment of $10 billion in CPFF LLC. The facility had $1.5 billion in outstanding loans on July 22.

Primary and Secondary Market Corporate Credit Facilities

The PMCCF and SMCCF were set up under section 13(3) to support credit to employers through purchases of newly issued bonds and support market liquidity for outstanding corporate bonds. These facilities operate through a special purpose vehicle, the Corporate Credit Facilities LLC (CCF LLC). The Treasury has made an equity investment of $37.5 billion in CCF LLC. The facilities had $12.1 billion in outstanding loans on July 22.

Municipal Liquidity Facility

The MLF provides liquidity to states, counties and cities. The facility was set up to purchase up to $500 billion of short-term notes and was established under section 13(3). The Treasury has made an equity investment of $17.5 billion in MLF LLC. The facility had $1.2 billion in outstanding loans on July 22.

Main Street Lending Programs

The MSF is established under section 13(3) to provide loans to SMEs. The program operates through three facilities: the Main Street New Loan Facility (MSNLF), the Main Street Priority Loan Facility (MSPLF), and the Main Street Expanded Loan Facility (MSELF). The loans are extended through a special purpose vehicle, the Main Street Facilities LLC (MSF LLC), established by the Federal Reserve Bank of Boston. The Treasury has made an equity investment of $37.5 billion in MSF LLC. The facility had $14 million in outstanding loans on July 22.

Term Asset-Backed Securities Loan Facility

The TALF is established under section 13(3) to provide liquidity guaranteed by asset-backed securities (ABS). Under the facility, the Federal Reserve lends to holders of certain AAA-rated ABS. The facility operates through a special purpose vehicle to extend its loans, the Term Asset-Backed Securities Loan Facility II LLC (TALF II LLC). The Treasury has made an equity investment of $10 billion in TALF II LLC. The facility had $937 million in outstanding loans on July 22.