A New Index of Bank Resolution Reforms

This guest blog post comes to us from Matteo Aquilina, Krishan Shah, Costas Stephanou and Jonathan Ward.

At the end of June, the Financial Stability Board (FSB) published a consultation report on its evaluation of the too-big-to-fail (TBTF) reforms for systemically important banks. The TBTF reforms[1] were endorsed by the G20 in the aftermath of the 2008 financial crisis and have been implemented in FSB jurisdictions over the past decade. The report examines the extent to which the reforms are reducing the systemic and moral hazard risks associated with global and domestic systemically important banks (G-SIBs and D-SIBs), as well as their broader effects on the financial system.

The evaluation carried out an extensive review of the literature and relied on published results where possible. It also carried out several new pieces of analysis, which are summarised in an extensive Technical Appendix. To support this analysis, following the approach of Beck et al. (2019), the FSB developed a resolution reform index (RRI). The index measures progress in the implementation of resolution reforms across FSB jurisdictions and has been used in two ways:

- As a descriptive statistic to show progress in implementing bank resolution reforms over time (2010-19) and across FSB jurisdictions.

- As an independent variable in regression analyses, to help provide insights on the credibility and effects of those reforms.

In this article, we present the design of the RRI and insights that it has produced so far. The underlying data for the index can be found here and we hope that researchers will use it in future analysis.

Developing the index:

The RRI captures a mixture of legislative and regulatory reforms and policy guidance on bank resolution. It does not include all of the reforms set out in the global standard (the FSB’s Key Attributes of Effective Resolution Regimes for Financial Institutions), as it is intended to be an explanatory variable and not a compliance tool. The index is also not a benchmark of the resolvability of individual SIBs in each jurisdiction, nor does it reflect authorities’ considerations in deciding whether and how to use different resolution tools.

The evaluation followed four design principles when determining which items to include in the index:

- Items should capture progress across the main areas of resolution reform introduced since the global financial crisis.

- Items should provide unique information, in order to facilitate the identification of the effects of resolution reforms. This involves selecting items that tend to have more variability and lower correlation across jurisdictions and over time.

- Items should be based on consistent and accurate data. The data was based on FSB progress reports and additional information collected from (and verified with) FSB jurisdictions.

- The relative weight of items within the RRI should reflect expert judgment. All weighting systems involve implicit assumptions about relative importance, so this index reflects what resolution authorities in the FSB consider to be important elements of an effective and credible resolution regime.[2]

The RRI comprises three sub-indices:

- The first sub-index covers resolution powers and recovery and resolution planning.

- The second sub-index covers operational policies and guidance of resolution regimes (as opposed to the legal framework).

- The third sub-index covers loss allocation, in particular whether authorities have powers to bail-in the creditors of failing SIBs and whether they impose external loss absorbing capacity (LAC) requirements on those banks.

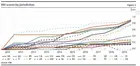

A number of conclusions emerge from the RRI panel data. First, there has been good overall progress by FSB jurisdictions in implementing bank resolution frameworks. Figure 1 shows the increase in the RRI over this period. A similar pattern, although with more divergence across jurisdictions, emerges in the sub-indices, which are shown in the consultation report. Most jurisdictions have created additional resolution powers and introduced recovery and resolution planning for SIBs. But progress in operationalising the resolution process – including loss allocation – is less advanced, as noted in the FSB’s latest resolution progress report (November 2019) and its thematic peer review on bank resolution planning (April 2019).

Second, Figure 2 shows that progress is most evident for jurisdictions that are home to G-SIBs. The progress made by these jurisdictions is not surprising, considering that most of them were among those most affected by the 2008 financial crisis and had good reasons to implement resolution reforms quickly.

The effects of resolution reforms

The index has been used in various analyses to assess how progress in the implementation of resolution reforms is related to indicators of systemic risk and moral hazard associated with SIBs. However, it is not always possible to attribute observed outcomes to the reforms. The evaluation has sought to establish a causal link between the reforms and observed outcomes using statistical techniques to the extent possible. However, some reforms were only recently implemented, while other reforms and unconventional monetary policies over the same period are confounding factors.

Resolution reforms and funding subsidies

Banks that are too big to fail enjoy an implicit funding subsidy. Creditors expecting to be bailed out by the government if the bank fails may be willing to fund such banks at lower rates than other banks. Such subsidies represent an undesirable economic distortion. They are, by definition, not observable. However, funding cost advantages of SIBs, compared to (for example) other banks or non-financial firms, can be used as a proxy for implicit subsidies.

A review of the literature suggests that SIBs’ funding cost advantages peaked during the 2008 financial crisis, remained high for a number of years, and then fell. In addition, the funding cost advantages are negatively correlated with the RRI. More comprehensive implementation of resolution reforms is associated with a reduced funding cost advantage for SIBs, and hence with less economic distortion. A number of approaches point towards this result.

First, by comparing the return on a portfolio of SIB equities with the return on a portfolio of equities of banks that are not SIBs, while accounting for other risk factors, the evaluation finds that the funding cost advantage of SIBs diminishes when there is progress in the implementation of resolution reforms.

Second, by comparing how CDS spreads have evolved for SIBs compared to other banks or large firms during the period in which reforms were implemented the evaluation finds some evidence that a higher value for the RRI is correlated with a larger decline of the funding cost advantage across all specifications.

Third, focusing on bond spreads in Canada, the evaluation finds that the overall effect from the index on spreads is insignificant, but the sub-component attributed to recovery and resolution powers (sub-index 1) is negative, indicating that Canadian SIBs’ funding costs increase when these reforms are implemented.

Fourth, using bond spreads in Europe, the evaluation finds a negative relationship between the funding cost advantage of SIBs and the RRI. This result is mainly driven by D-SIBs.

Finally, using equity-implied CDS spreads the evaluation finds that the RRI is negatively correlated with funding cost advantages.

Broader effects of resolution reforms

One important question in the evaluation is whether the reforms have affected the supply of credit to the economy. The evaluation examined the hypothesis that, following the introduction of tighter prudential requirements, G-SIBs reduced their supply of credit as a proportion of GDP. This was the main concern about “unintended consequences” that was mentioned by some external stakeholders in their response to the call for public feedback.

The evaluation found that the level of G-SIBs’ domestic credit relative to GDP is negatively related to the RRI. The more advanced is the implementation of the resolution reforms the lower is the level of G-SIBs’ contribution to credit-to-GDP. The results are economically significant. A one standard deviation increase in the RRI (0.26 on average) is associated with a 1 percentage point lower ratio of G-SIBs’ domestic credit to GDP.

However, when using credit from other firms (D-SIBs, other banks, and non-bank financial intermediaries) as a dependent variable, the coefficient on the RRI is not significant. This suggests that there is no relationship between such firms’ aggregate credit supply and the resolution reforms.

It should be noted that the welfare consequences of a reduction or increase in credit supply are ambiguous. If credit falls relative to GDP, in an environment where the level is not above the optimum, it could be detrimental for growth unless other sources of credit pick up the slack. If lending is higher than optimal – a feature of the period that preceded the global financial crisis – a gradual reduction in credit would actually be beneficial from a welfare and financial stability perspective (Cecchetti et al., 2011).

The last piece of analysis performed with the RRI relates to the degree to which SIBs are similar. Holding common or correlated assets may expose banks to the same type of shocks, exacerbating losses in the system should such shocks occur. A key question in the evaluation is therefore whether the reforms have caused G-SIBs’ asset allocation to converge. The evidence suggests that G-SIBs’ asset similarity increased gradually from the early 2000s. The increase, though statistically significant, is small and probably has no material economic consequence. However, the estimated coefficient on the RRI is always significant and negative: advances in implementation of the resolution framework are associated with more heterogeneity in G-SIBs’ portfolios. This casts doubt on the hypothesis that it was resolution reforms that caused bank asset portfolios to converge.

Conclusions

The RRI is a powerful tool for measuring progress in the implementation of resolution reforms. It can also be used in empirical analyses to understand the effects of resolution reforms on various indicators of bank performance. The TBTF evaluation provides several examples of how such an index can help provide answers to the question on whether resolution reforms have achieved their intended objectives. We hope that the index will be used in future research by other researchers. Questions to be analysed include the political economy of resolution reforms: when and why did authorities initiate the reforms and whether causality between resolution reforms and outcome variables of interest can be established.

[1] The TBTF reforms have three components: (i) standards for additional loss absorbency through capital surcharges and total loss-absorbing capacity requirements; (ii) recommendations for enhanced supervision and heightened supervisory expectations; and (iii) policies to put in place effective resolution regimes and resolution planning to improve the resolvability of systemically important banks (SIBs).

[2] As a robustness check, the FSB also developed an alternative index in which all components are equally weighted. The main results, described below, were not significantly affected.