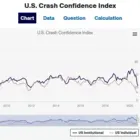

Prof. Robert Shiller's U.S. Crash Confidence Index

Professor Robert Shiller may be well known for his cyclically adjusted price-to-earnings ratio (CAPE ratio) and Case-Shiller Home Price Indices but it’s his U.S. Stock Market Confidence Indices that have been receiving a lot of attention lately.

Beginning in 1984, Professor Shiller began collecting questionnaire survey data on the behavior of US investors, making it the longest-running effort to measure investor confidence and related investor attitudes. Under the direction of Shiller, the Investor Behavior Project at Yale University is now under the auspices of the Yale International Center for Finance. Survey data is updated monthly and posted on the Yale ICF website along with interactive graphs dislaying the U.S. Stock Market Confidence Indices dating back to October 1989.

About the U.S. Stock Market Confidence Indices

Confidence in the stock market is much harder to pin down than is consumer confidence, since the judgments people make about the stock market are among the most involved of any that they must make. There is likely to be more complexity to people’s views about the stock market than there is about their decisions whether to save more now or whether to buy a new sofa, which consumer confidence indexes emphasize.

Most recently, the U.S. Crash Confidence Index has been referenced frequently when trying to predict the possibility of a stock market crash. Professor Shiller cited the crash confidence index in his October 2020 Op-Ed for the New York Times stating that “people fear a stock market crash more than they have in years.”

In the questionnaire, Shiller asks: What do you think is the probability of a catastrophic stock market crash in the U. S., like that of October 28, 1929 or October 19, 1987, in the next six months, including the case that a crash occurred in the other countries and spreads to the U. S.? (An answer of 0% means that it cannot happen, an answer of 100% means it is sure to happen.) [Fill in one number]

This index displays the percent of the population who attach little probability of a stock market crash in the next six months. The Crash Confidence Index is the percentage of respondents who think that the probability is strictly less than 10%. In his Op-Ed, Shiller noted that the percentage of individual investors who held confidence in the stock market actually hit a record low of just 13% in August 2020 but went up to 15% in September 2020 (as seen in the graph below).

Results of the Investor Behavior Survey are posted monthly on the U.S. Stock Market Confidence Indices section of the Yale ICF website. Visit the website to learn more and view interactive graphs currently displaying survey results from October 1989 through September 2020 for the:

-

U.S. One-Year Confidence Index

-

U.S. Buy-on-Dips Confidence Index

-

U.S. Crash Confidence Index

-

U.S. Valuation Confidence Index

Please visit the U.S. Stock Market Indices website for permission and copyright information before using any data.

Data collection is supported by Andrew Redleaf of the Lynne and Andrew Redleaf Foundation (previously Whitebox Advisors). Data Collection in the past has been supported in part by grants from the U. S. National Science Foundation and from Case Shiller Weiss, Inc.