A Flourishing Passion for Impact Investing at Yale SOM

Jenn Burka ’21 and Nina Ligon ’21 share their experiences being involved with the many impact investing-related activities and opportunities available to students at Yale SOM.

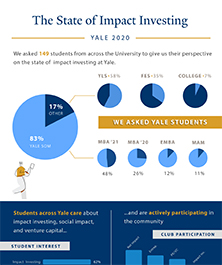

As part of launching Fishbowl Ventures, a student-run impact investing fund, we recently surveyed the Yale SOM student body to better understand the state of impact investing here at SOM. We were thrilled to receive approximately 150 responses that demonstrate strong interest across the school in impact investing, with high participation in curricular and experiential learning opportunities at the intersection of impact investing and venture capital.

on the state of impact investing at Yale

More than 60% of the students we surveyed expressed an interest in impact investing, venture capital, and social impact. Students also reported involvement in a wide variety of impact-related activities on campus, both at SOM and in the greater Yale community. While COVID-19 has greatly impacted the impact investing competitions that we participated in this year—along with every other aspect of student life—it has also brought to mind how important impact is to the future of our planet and the health of the people living here.

We, too, share this passion for and belief in impact investing, and we wanted to relate our own experiences with it at Yale SOM to shed some light on the opportunities available.

Jenn’s Path to Becoming a VCIC Regional Champion

A large reason that I came to Yale SOM was because I was interested in identifying leaders in sustainable and impactful investing practices, and I felt that SOM’s mission would offer me a great opportunity to explore the intersection of impact investing and venture capital with like-minded individuals.

Throughout my first year here, I have pursued opportunities that allow me to work with those looking to have a positive impact on the world while achieving financial viability. These opportunities have included serving as a first-year leader for Fishbowl Ventures, acting as a team leader for the MIINT (MBA Impact Investing Network & Training) Competition, engaging as a student in the core finance classes and Sue Carter’s Private Capital & Impact Investing class, and competing in the Venture Capital Investment Competition (VCIC).

VCIC is one of the oldest and most competitive global VC competitions, with more than 70 universities competing worldwide. This year, Yale held an internal competition in order to prepare a team to send to the Northeast Regionals at Dartmouth Tuck. The competition is a 48-hour due diligence and term sheet marathon in which we research three startsups before getting to meet them in person for a rapid-fire due diligence interview with a panel of esteemed venture capitalists watching our every move. Following the company meetings, we had one hour to put together a VC-level term sheet, which we then presented and defended to the panel of judges. My team won the internal competition in December for our proposed investment in Inbox Health, a tech-enabled medical billing company that has since closed a round for $3.5 million.

At the regional competition in February, Lisett Luik ’21, Pradyut Paul ’21, Sumedh Deshpande ’21, and I found ourselves deciding between two startups to invest in: a very traditional investment in a fintech company, and a potentially riskier investment in a company called MentorWorks, which provides education financing for students through Income Sharing Agreements (ISAs) along with mentorship and support. We ultimately chose MentorWorks and framed our team’s fund as an impact firm that would not only invest in the company, but also in the ISA itself (with the opportunity for that investment plus interest to convert to equity) in order to truly show our commitment to the company’s mission. The judges loved the risks we took in defining our thesis, and we won the competition!

Unfortunately, due to COVID-19, the global competition at UNC-Chapel Hill was cancelled this year, yet the lessons my team learned about creating relationships with founders and staying true to an impact thesis will stick with me as I act as a second-year leader for Fishbowl Ventures and MIINT next year.

Nina’s Path to the MIINT (Virtual) Finals

Having worked in startups for the past four years, I joined MIINT and Fishbowl for the chance to get hands-on experience being on the other side of the table when it comes to funding decisions. The MBA Impact Investing Network and Training Competition (aka MIINT) is a program hosted by the Wharton Social Impact Initiative and the Bridges Impact Foundation. Every April, MIINT brings together teams from 30-plus schools across the globe to pitch their proposed investment in a startup for the chance to win a real $50,000 investment in that company.

Our team’s journey began back in September, when David Reddy ’21, Suneet Mohapatra ’21, Master of Advanced Management candidate Irene Li ’20, Peter Ormsby ’21, and I came together over a shared interest in sustainable infrastructure and transportation. As one of five teams each approaching the program from a different impact lens, we spent the next five months learning the fundamentals of impact investing. We went from identifying a core investment thesis to sourcing, to diligence, all culminating in a final SOM internal competition to determine which team would represent Yale at nationals in April. Our team won the spot with our proposed investment in CLIP, a portable bike accessory that can transform any bike into an ebike in seconds—providing commuters with a more affordable, efficient, and sustainable mode of transport. Next up was to pitch to the MIINT investment committee from April 1 to 4 in the hopes of bringing home a third win for SOM and solidifying our reputation as a leader in impact investing education.

You can imagine our relief when MIINT committed to taking the competition remote instead of canceling it outright. Since their announcement in early March, the MIINT national team has gone above and beyond to ensure we still have a valuable and fair experience. They hosted Q&As, developed a flexible schedule for pitching, and tweaked their judging criteria and bias training to account for the challenges of remote presenting. On April 2, we joined 30 other MBA programs in remotely pitching our proposed investments to a panel of MIINT judges over Zoom. Participants were invited to join and watch each other’s pitches, and the final seven teams who qualified for the finals were given feedback to prepare for the finals on April 4. That Saturday, as one of seven finalist teams, we pitched an investment in CLIP one final time to the MIINT judging panel. While we sadly didn’t take home the final prize of a $50,000 investment in CLIP (and a three-pete for Yale), we had an amazing experience representing SOM in the finals. I’m incredibly thankful that MIINT committed to running the competition through a quality, albeit sometimes awkward, remote format, allowing us to get the full experience and value of the program.

It gives me comfort to know that as the COVID-19 crisis continues to unfold, MIINT has recognized that now, more than ever, it’s critical to support companies that are working to make our societies more equitable, sustainable, and accessible.

Carrying Impact Forward

Here at SOM, we believe that impact investing isn’t just a trend. The challenges that our world faces—like COVID-19 and climate change—require mission-driven leaders who can navigate political, technical, and business complexities, and student interest for learning about how to manage these initiatives continues to grow. For this reason, the Fishbowl Ventures team is excited to launch an impact fund at SOM to equip our classmates with first-hand experience, preparing them for their futures as true leaders for business and society.