Conference Recap: Yale Impact Investing Conference 2019

On April 5, 2019, the International Center for Finance hosted the second annual Yale Impact Investing Conference at the Yale School of Management. The conference brought together investors, academics and philanthropists to discuss metrics for impact and the newest ideas to generate market-level returns through impact investments. The ICF joined forces with two Yale School of Management MBA for Executives students, Julie Cochran ’20 and Vish Mazumder ’20, to bring the conference to life. These students were in charge of the content of the conference and worked closely with several other MBA for Executives students to help organize the speakers and panels over the course of several months.

This year, the Yale Impact Investing Conference 2019 focused on an exploration of the transformative power of capital to change the world’s trajectory through investments that value healthy people and healthy environments across multiple metrics. These goals can only be reached by bringing best practices in impact investing to scale. Although there is growing demand for ethical investment products, there are major challenges that prevent investors from moving from billions of dollars under investment in impact funds to trillions.

Human Motivations and Narratives”

Professor Teresa Chahine opened the conference by explaining what exactly impact investing is and how important it is to make a positive contribution on top of making a return on your investment. She then introduced Keynote Speaker, Professor Robert Shiller, who spoke about the phenomenon of impact investing. Interestingly, he cited that the term “impact investing” first appeared in 1993 but didn’t really take off until the 2010’s and interest and the practice of impact investing has since sky rocketed. During his presentation, Shiller stated that, “Human enterprise is guided by institutional structures that have subtle effects on motivation and creativity. Impact investing creates a narrative that brings in people with skills and motivations that can enhance effectiveness. There is an important niche for impact investing.”

Erika Karp, Founder & CEO of Cornerstone Capital Inc., spoke briefly about the transformative power of capital to change the world’s trajectory in which she exclaimed that, “All investments have impact.” Karp carried this theme through to the next panel that she moderated about, “Generating above market returns: prioritizing SDG’s and how investors engage with companies to drive change and investment returns.” Panelists included Robert Brown, Atlas Impact Partners; Tony Davis, Inherent Group; and Diana Propper de Callejon, Cranemere, Inc. The panelists all agreed that the UN Sustainable Development Goals are fundamentally important to keep in mind but that it’s ultimately the job of the advisor to find ways to properly and effectively incorporate them into their investments to truly make a meaningful impact.

The next panel was moderated by student conference organizer, Julie Cochran ’20. The theme of the panel centered around, “Building resilient infrastructure: Improving cities to enhance economic growth for more people.” Each of the panelists gave an overview of their companies and brought unique perspectives about investing in opportunity zones to make an impact in revitalizing and bringing access to certain areas. The panelists included: Vincent Felteau, Ivanhoé Cambridge; Jonathan D. Tower, Arctaris; and Jase Wilson, Neighborly.

device made with the intention of making

an impact.

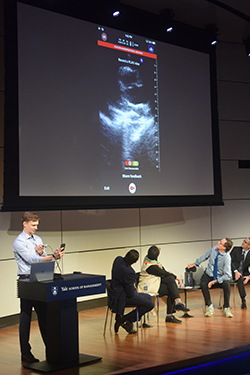

Later in the afternoon, Moderator Sri Muthu, HealthVenture and panelists Mary-Ann Etiebet, Merck for Mothers; Jonathan Rothberg, 4Catalyzer; and Peter Schulam, Yale New Haven Health System had a great conversation about, “Investing to promote well-being/Health for all at all ages.” Each of the panelists talked about how imperative it is to find ways to make an impact with your investment in healthcare because this is something that everyone can benefit from. For example, Dr. Jonathan Rothberg and his team demonstrated a medical device that he developed with the intention to make an impact. As seen in the photo, it is a cost-effective ultrasound machine (roughly $2,000 USD) that plugs into an iPhone and allows any person to perform an ultrasound that can be sent to a medical expert to evaluate. This is extremely unique because it can be used in remote parts of the world where access to the right equipment is scarce.

The next afternoon panel focused on the topic of making an impact with your investment in energy. Scott Brown, New Energy Capital, spoke first about clean energy infrastructure, noting that there are plenty of clean energy market opportunities today due to increasing competitiveness with cost reductions, clean energy policies are strengthening, and coal retirement. Next Bethany Gorham, Energy Impact Partners, spoke about making an impact by investing in the “fuels of the future” and focusing on technologies that can help drive the energy transformation. And lastly Andrew Hughes, Generate Capital, spoke about how his company makes an impact by providing capital to projects to help deploy sustainable infrastructure.

The last presenter of the day was Hans Op ‘t Veld, Head of Responsible Investing at PGGM. Op ‘t Veld closed the conference by talking about the institutional investors’ perspective on the transformative power of capital to drive positive changes. He talked about how he has seen his company successfully implement impact investing by finding investable themes, many of which allign with the UN Sustainable Development Goals, and by having credible and measurable contributions. Op ‘t Veld stated that “achieving impact is easy in theory, but hard in practice.” Op ‘t Veld then quoted BlackRock CEO Larry Fink, who believes that within the next 5 years, companies will be measured based on their impact on society, government, and the environment to determine its worth. With new regulations and more access to knowledge and resources, companies will be able to better target investments with a positive contribution.

The day ended with a joint cocktail reception sponsored by TSAI City, Yale Center for Business and the Environment, and InnovateHealth Yale who had just completed a three-day pitch competition called Startup Yale. Entrepreneurship awards were given to the best pitches for their world-changing ideas! It was a wonderful way for several Yale organizations and people to come together in their shared passion for impact investing.

Click here to view a photo timeline of the day.

Thank you to the following MBA for Executives students for all of their hard work: Julie Cochran, Vish Mazumder, Ryan Barry, Caleb Cheng, Martha Deeds, June-Marie Fitzmartyn-Innes, Paul Fu, and Bill Peng.

Follow @YaleICF on twitter and relive the day by viewing tweets from the conference using the hashtag #yaleimpactinvesting2019