Conference Recap: The Rise of Machine Learning in Asset Management

The Rise of Machine Learning in Asset Management Conference drew nearly 300 academics, students, and practitioners to the Yale School of Management on Friday, October 5, 2018. The conference was organized by Professor Bryan Kelly and hosted by the International Center for Finance . The day was filled with presentations answering the questions, “What is machine learning/artificial intelligence?” and “How is machine learning/AI being applied within the financial industry?”

Marcos López de Prado, Principal, AQR Capital Management, LLC., opened the conference by addressing the Ten Financial Applications of Machine Learning. He noted that some of the benefits to using machine learning in asset management include the fact that predictions are made without bias and that one can process a large amount of data and identify patterns or change more efficiently. Machine learning is used to successfully replicate algorithms as a way to verify predictions. Machine learning in asset management is best used when the goal is to estimate the probability of something occurring.

Charles Elkan, Managing Director at Goldman Sachs, echoed the statement made by López de Prado that machine learning/deep learning is best used for predictive purposes like forecasting in the finance industry and that it will yield a higher accuracy of results. Interestingly, Elkan points out that current AI methods can only achieve a shallow level of understanding and answer a limited range of questions. AI methods cannot comprehend anything that is multilayered, involves broad context or that uses broad knowledge. These setbacks also seem like something that may not be corrected in the foreseeable future without some kind of human intervention.

After the first two presenters, a panel of entrepreneurs discussed the role of machine learning and artificial intelligence in entrepreneurship. The panel consisted of Jason Briggs, COO, Diffeo, Shaheen Kanda, CEO and Founder, first AI, and Nathan Stevenson, CEO and Founder, ForwardLane Inc. Moderator Marina Niessner, AQR Capital Management, LLC., opened the panel with a brief overview of machine learning and its social impact. Although society and the media highlight the negative sides of machine learning/artificial intelligence, the panelists agreed that most people do not fully understand the true meaning or potential for machine learning/artificial intelligence to better the workplace and society.

The next topic that the panelists discussed was about the advantages and disadvantages of startups in the machine learning word. All three of the panelists talked about the feasibility or lack thereof, for small businesses to effectively apply machine learning to their companies because of the lack of resources or capital and the scale required to have it function adequately. As a small business, it’s not always possible to have the appropriate resources for implementing machine learning.

And lastly, the panelists discussed the issue of human bias. Machine learning removes humans from the decision making process so that the decisions are based on the algorithms alone. Some people worry that biases could be built into the training information because computers are being given the information from humans or from past instances where a human dictated the outcomes.

[WATCH] Click on the video below to the view the panel discussion.

The afternoon sessions began again with a talk about Big Data, Smart Beta, and the future of investing by Ronald Kahn and Bradley Betts, both Managing Directors at BlackRock.

Next, Afsheen Afshar, a deep AI expert, spoke about the current state and challenges for applying data science/AI to enterprises. Afshar explained that many companies surprisingly still aren’t leveraging machine learning/AI to analyze customer or product data because of the lack of understanding of how to do so properly. It is crucial to invest in the right people, process, and platform in order to see positive results. Properly functioning AI models will yield valuable predictive information for businesses and the analysis then needs to be properly communicated to non-technical staff or stakeholders who may not understand what AI is, how it is applied, and how it functions so that they can see the value in it as well.

Yves-Laurent Kom Samo, Founder & CEO, Pit.AI Technologies, referenced several mathematical approaches used to measure diversification with machine learning during his presentation. He pointed out that although a machine or algorithm can find new trading strategies, you ultimately need to find a way to assess whether the new strategies or new assets that you are trading are actually adding any value or diversification to your portfolio. Therefore, to assess risk properly using machine learning, it’s important to look for new statistical learning techniques that are finance focused and not rely solely on old models or beliefs.

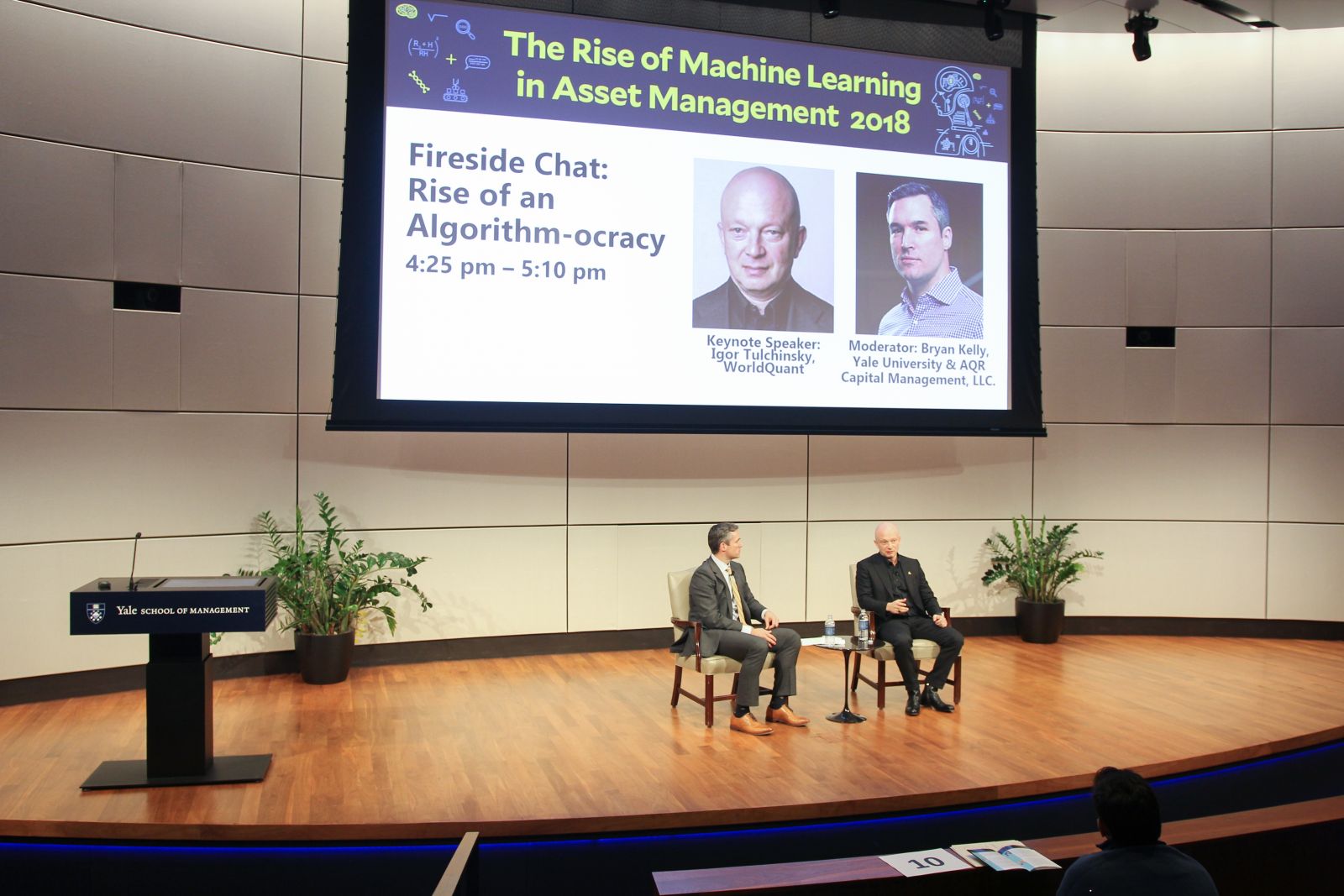

The last session of the day was a fireside chat with Keynote speaker Igor Tulchinsky, Founder, Chairman and CEO of WorldQuant, and moderated by Professor Bryan Kelly. Igor spoke about the role of machine learning/artificial intelligence in the industry and how it’s used in his company’s process. Upon the conclusion of the conference, Igor signed copies of his latest book, “ The UnRules: Man, Machines and the Quest to Master Markets .”